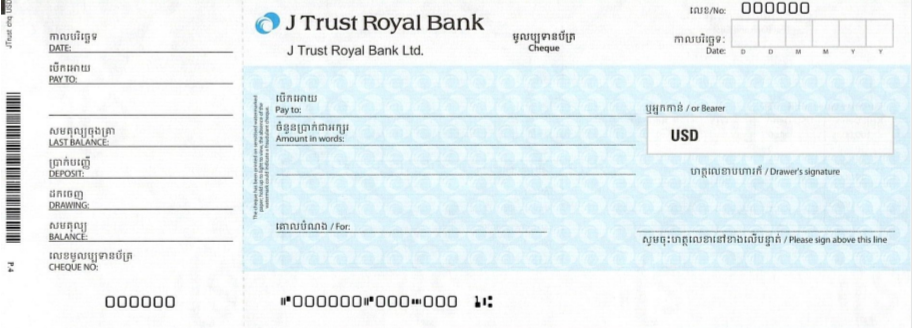

Call us on 132 032 8am – 8pm Sydney time.If you write a cheque and want to stop the payment, you can: Once you deposit a cheque, the funds are normally available after three business days. If a return address has not been provided, reasonable efforts will be made to forward the cheques to the account holder, who will need to contact the sender to resolve the matter. Where a return address has been provided, cheques that can’t be deposited will be returned to you. Will my cheque be returned by post if it can’t be deposited? Delays may also occur where a high volume of cheques are lodged. Calculate postage and delivery times on the Australia Post website.ĭelays in processing your cheque may occur in the event of incorrect, incomplete or missing deposit slips. Remember that the time it takes for a cheque to reach us is dependent on Australia Post and differs from region to region. This time may vary due to unusually high demand for electronic processing at present. Our aim is to process cheques on the same day we receive them and, once processed, the standard three business days for funds to clear still applies. How long will it take to process a cheque deposited by post? We also cannot deposit cheques posted without your unique pre-printed Deposit slip. Any other cheque that would ordinarily not be accepted within a branch.Payee name, amount in words, amount in figures, Drawer’s signature),or incorrect may be dishonoured by the paying financial institution cheques that are future dated, stale (dated more than 15 months ago at time of receipt by Westpac, not authorised, physically altered (without initialisation by drawer), damaged, missing details (i.e.cheques made out to someone who is not you.Please note we are unable to accept by post: Make and keep a copy of the cheque or a listing of the cheque details (Cheque number, BSB, Account number, amount, date, drawer name), until the funds clear in case the cheque is lost or damaged. Write a return name, address and contact number on the back of the envelope.You will need to complete the fields for postage date, total cheque amount, total deposit amount, and the total number of cheques Your deposit slip must be fully completed and correctly record all of the details of your deposit. You must include your pre-printed Westpac Deposit Slip in the envelope.

Use a regular envelope, you will need to apply a stamp.

#Bank of america request chequebook how to#

How to deposit a cheque with Westpac by post:

0 kommentar(er)

0 kommentar(er)